Chaos Theory, with its fundamental principle of the “butterfly effect,”...

Read MoreTable of Contents

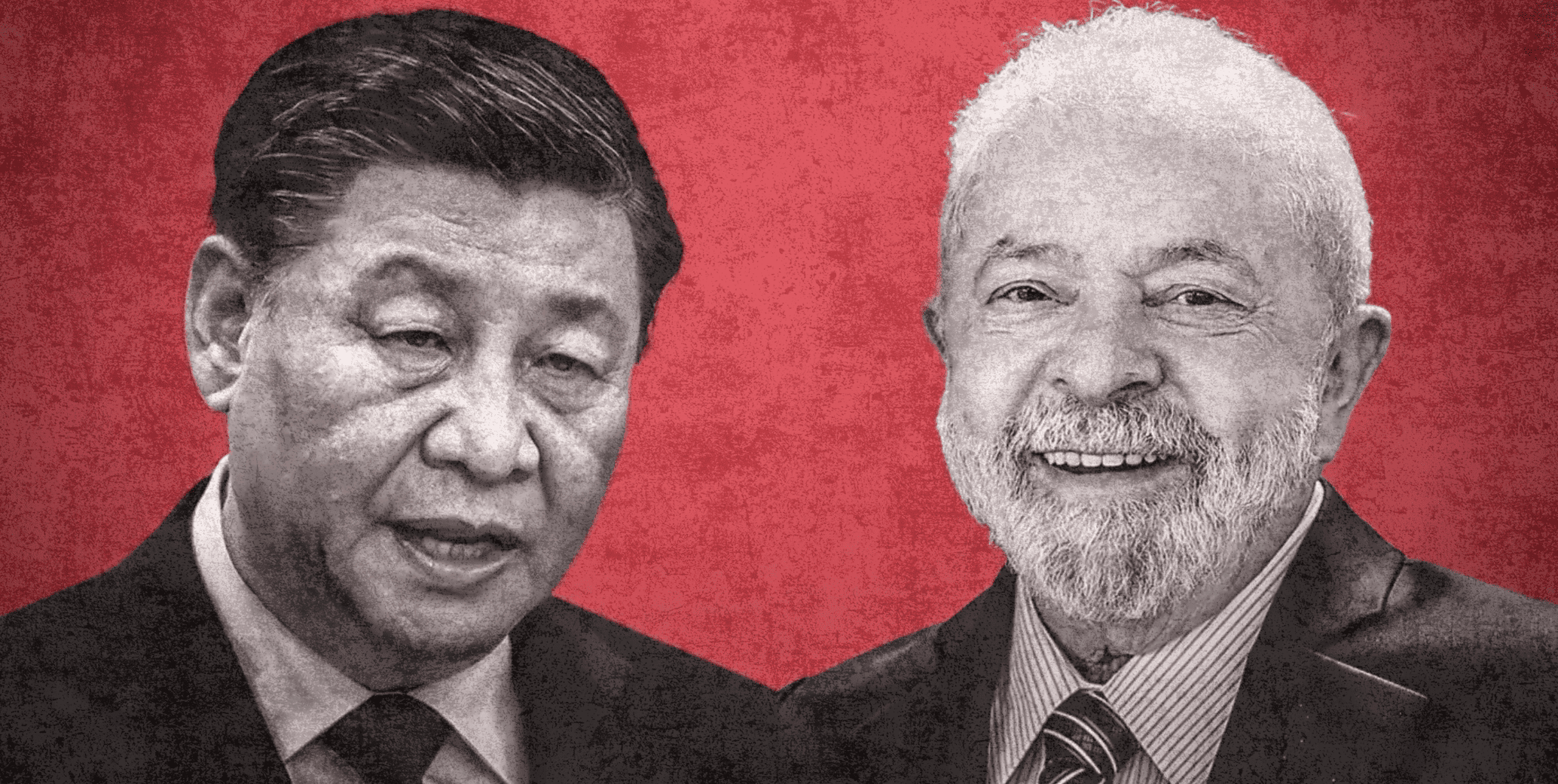

How Chinese SMEs Can Benefit from the China-Brazil Currency Swap Agreement

The China-Brazil currency swap agreement offers a strategic advantage for Chinese SMEs investing in Brazil

How Chinese SMEs Can Benefit from the China-Brazil Currency Swap Agreement

Trade between China and Brazil has grown significantly in recent years, with Chinese companies increasingly investing in Brazil’s agriculture, infrastructure, and electronics markets. However, currency exchange risks and high transaction costs can be major challenges for Chinese SMEs operating in Brazil.

One powerful but often overlooked financial tool is the currency swap agreement between the People’s Bank of China (PBoC) and the Central Bank of Brazil (BCB). This mechanism allows businesses to exchange Chinese yuan (RMB) for Brazilian reais (BRL) directly, bypassing the US dollar and reducing costs.

What Is the China-Brazil Currency Swap?

A currency swap is an agreement between two central banks to exchange their currencies at a pre-determined rate. The PBoC and BCB established a 190 billion yuan (≈ $30 billion) swap line in 2013, which has been renewed multiple times since.

How It Works

Chinese companies can access Brazilian reais without converting yuan into dollars first.

Brazilian importers can pay Chinese suppliers in yuan, avoiding dollar-based FX risks.

The swap locks in exchange rates, protecting businesses from sudden currency fluctuations.

Key Benefits for Chinese SMEs in Brazil

– Lower Transaction Costs for China-Brazil Trade

Normally, converting yuan → dollar → real involves double conversion fees and bank spreads.

The swap allows direct yuan-real conversion, reducing costs for:

Export to Brazil from China (e.g., electronics, machinery).

Import from Brazil to China (e.g., soybeans, iron ore).

– Stable Exchange Rates for Long-Term Investments

Chinese companies investing in Brazilian infrastructure, agriculture, or manufacturing face currency risks.

The swap provides fixed-rate exchanges, ensuring predictable costs.

– Easier Access to Brazilian Reais for Local Operations

If a Chinese SME has expenses in Brazil (e.g., salaries, taxes, local suppliers), the swap helps secure reais at a favorable rate.

Avoids reliance on the volatile black-market exchange rate.

– Cheaper Financing Options

Chinese firms can borrow reais through swap-backed credit lines instead of taking dollar loans with high interest.

Helps with working capital, expansion, and large projects (e.g., China-Brazil infrastructure investments).

Practical Applications for Chinese Businesses

Case 1: Exporting Electronics to Brazil

A Chinese electronics manufacturer sells smartphones to Brazilian retailers.

Instead of receiving payments in USD (with conversion fees), they can invoice in reais and use the swap to convert back to yuan at a stable rate.

Case 2: Investing in Brazilian Agriculture

A Chinese agribusiness company buys farmland in Brazil.

They can use the swap to transfer yuan into reais for land purchases, avoiding dollar fluctuations.

Case 3: Importing Brazilian Commodities

A Chinese food processor imports Brazilian soybeans.

They can pay suppliers in reais obtained via the swap, reducing dependency on USD.

How to Access the Swap as a Chinese SME

While the swap is negotiated between central banks, businesses can access it through:

Partnering with Major Chinese Banks (e.g., ICBC, Bank of China) that facilitate swap transactions.

Working with Brazilian Banks (e.g., Banco do Brasil, Bradesco) that support yuan-real settlements.

Consulting Financial Advisors to structure swap-based financing for investments.

Challenges and Considerations

Not All Banks Offer Swap Services – SMEs may need to work with larger financial institutions.

Limited Awareness – Many businesses still rely on traditional FX methods. Regulatory Compliance – Proper documentation is required for swap-based transactions.

Final Thoughts

The China-Brazil currency swap is a powerful financial instrument that can:

Reduce costs for Chinese exporters and investors.

Minimize FX risks in volatile markets.

Strengthen economic ties between China and Brazil.

For Chinese SMEs in Brazil, leveraging this mechanism can mean higher profits, smoother operations, and better financial stability.

Next Steps for Chinese Businesses

- Talk to your bank about swap-backed transactions.

- Consult trade experts to optimize cross-border payments.

- Monitor BCB and PBoC updates on swap renewals and quotas.

By using the swap wisely, Chinese companies can gain a competitive edge in the Brazilian market while supporting long-term China-Brazil trade growth.

If Brazil is on your radar, let’s talk. We’d love to be your bridge to Latin America.

Feel free to send us an email or schedule a quick chat here:

Share With Your Network

How to Start a Business

Brazil is full of opportunity — but bureaucracy can be...

Read MoreWhy Your Business Needs a

A temporary fiscal address is an officially registered location that...

Read MoreHow Chinese SMEs Can Benefit

The China-Brazil currency swap agreement offers a strategic advantage for...

Read More