The Butterfly Effect in International Relations: Chaos Theory and the Reconfiguration of the Contemporary Geopolitical Order

Chaos Theory, with its fundamental principle of the “butterfly effect,” proposes that small initial changes in a system can generate significant and unpredictable impacts over time.

How to Start a Business in Brazil: A Strategic Guide for Foreign Companies

Brazil is full of opportunity — but bureaucracy can be a challenge. This guide walks you through the legal process of starting a company as a foreign investor, with expert support from Albatroz Advisory.

Why Your Business Needs a Temporary Fiscal Address in Brazil

A temporary fiscal address is an officially registered location that allows foreign companies to begin legal operations in Brazil without immediately establishing a physical office or deploying a local team.

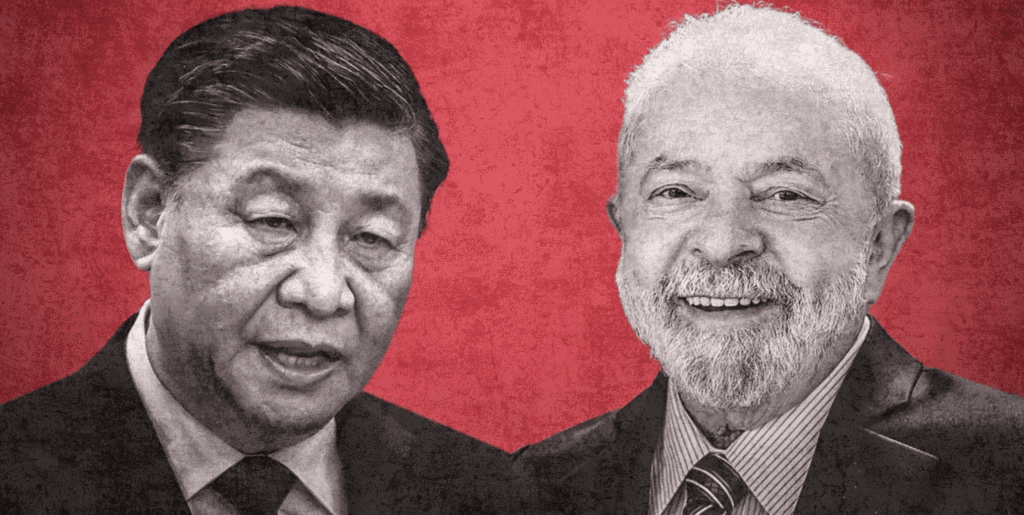

How Chinese SMEs Can Benefit from the China-Brazil Currency Swap Agreement

The China-Brazil currency swap agreement offers a strategic advantage for Chinese SMEs investing in Brazil, helping them cut costs, avoid dollar dependency, and secure stable exchange rates.

Top Challenges When Chinese SMEs Export to Brazil

This guide highlights the key obstacles and how to overcome them for a successful market entry.

Brazil Market Entry Guide for Indian SMEs: Opportunities & Strategies

Agribusiness & Food Products (Spices, tea, and processed foods)

For Indian exporters to Brazil, the market is ripe—but success depends on navigating local regulations and competition effectively.

How to Start a Company in Brazil: A Guide for Foreign Investors

Each structure has specific tax and legal implications, making professional advice crucial.

“We Don’t Need Them.” Really?

No nation thrives in isolation—global interdependence is structural, cultural, and essential for efficiency, sustainability, and progress.

Between Tariff and Diplomacy

A new Brazil–China sea route redefines South American trade, cutting costs, creating jobs, and reshaping regional geopolitical influence.

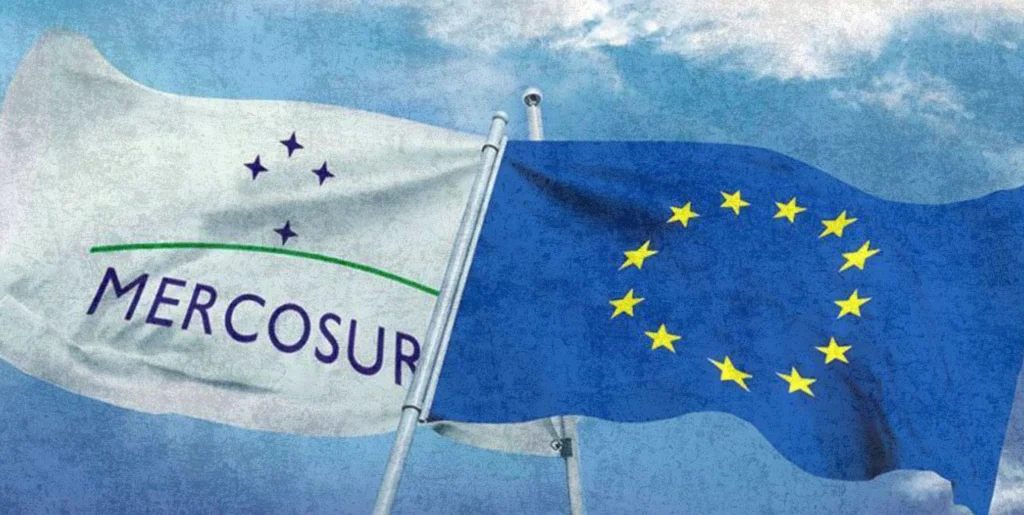

The Impact of the Mercosur-EU Agreement

A historic deal with cautious optimism—Mercosur-EU trade pact promises growth, but demands resilience from vulnerable domestic industries.